By Paul Cole and Warren Moollan of inQuba and Robin Spaulding of Capgemini

First published in Claims Magazine, June 2016 issue.

Interaction between a policyholder and their insurance company tends to take place only during the purchasing cycle and when a claim must be filed, and the lengthy gap between those two events leaves very little room for the insurer to develop any sort of meaningful customer relationship. This limited model of engagement is seriously outdated and does not resonate with Gen Y consumers – and insurers’ greatest challenge today is to change the Customer Experience to build loyalty with this demographic, by developing meaningful interactions during that gap period.

According to CapGemini’s “World Insurance Report 2016,” Gen Y tends to have lower Customer Experience (CX) scores than older people, with only 33.9 percent of Gen Y customers reporting positive experiences with insurers compared to 55.4 percent of non-Gen Y customers. This more engaged, more demanding demographic wants more frequent interactions. They expect to have multiple channels, including digital, at their disposal, and they expect to have more participation throughout the duration of the policy.

Understanding context

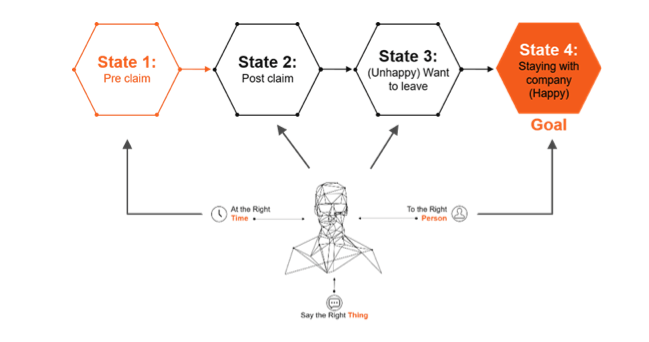

When the policyholder needs to file a claim – the point at which they need their insurer the most – they will be in an emotional state of mind, and the fact that they may have had little to no interaction for several months or years makes the process much more difficult than it has to be. Furthermore, the rigid and linear process is bound to make the Customer Experience frustrating, because that process does not take into account the context in which the claim is being filed. A more flexible interaction model takes into account the different states of mind the policyholder may be experiencing, as shown below:

What is required is a move away from interacting with a client from a Journey Map to interfacing with a client based on the client’s context. This requires empathy, or understanding the client’s context and having the ability to say the right thing at the most appropriate time to the correct person.

Into the Valley of Desolation

The period of time between when a client purchases an insurance product and when they need it – the “Valley of Desolation” – is far too passive and does not meet the needs of today’s more highly engaged consumers. Even during the purchase period, there is very little customized communication; rather, much of it is tedious due to the regulatory and compliance environment. During the gap between purchase and claim the only interaction may be during renewal time or if there is a change in pricing, leaving the policyholder with the impression that the only time the insurer contacts them is when they are asking for money. This approach cannot build loyalty, especially among the more highly engaged Gen Y audience.

The other end of the Valley of Desolation – the claims process – is also typically very difficult to manage, often because the client has had no engagement or meaningful relationship with the insurer, and they may not know how to navigate the system.

Some of the more obvious but difficult to fulfill challenges of a claims process are the following:

- The clients don’t always enter the system at the same point. They may use the call center, company designed application, Web, etc.

- The nature and complexity of the process leads to a very different experience for each incident.

- The timing of the registration of the claim.

- The client complains about an incident on social media. The insurer now must be flexible enough to communicate via social media channels.

The CXtended Communication Strategy

If companies base their strategy on process rather than each client’s unique situation, then how they communicate and ask for information from a client will not address the client’s state at the most critical time. Instead, the system should be intelligently designed to understand the client’s state of mind at the time, and be flexible enough to communicate appropriately while giving the client a range of options based on context, with interventions designed to suit each client situation. For example, if a client whose vehicle is undriveable calls to register a claim, respond by saying, “We apologize for the inconvenience caused by not being able to drive your vehicle due to the serious nature of the accident. However, your policy does include Hired Vehicle benefits.”

A more comprehensive and empathetic context map is depicted below based on the inQuba CXtended philosophy of “Listen, Learn and Engage” with the right customer at the right time, saying the right thing. Each client will have an entirely different strategy and operating model depending on an understanding of Context. This model solves both problems facing the insurance company today: The “Valley of Desolation” gap period of no communication, and the confusion that results when a claim must be filed.

Designing strategies to interact with the client during the quiet periods will not only alleviate the tension around the claims experience but also ensure a smoother, less cumbersome, and less costly claims experience for both parties.

The CXtended view would include tactics such as:

- Trigger personalized email asking client how he/she what they would do to improve the product

- Introduce Special offers

- Thank client for regular payments

- Remind client of No Claim Bonus

- Introduce client to Value added products

- Provide Tips and Advice

A CXtended view that engages customers during that often lengthy “Valley of Desolation” period brings insurers two significant benefits: It reinforces loyalty, and at the same time it helps create a smoother and less cumbersome claims process, since policyholders will be more familiar with and more comfortable with interacting with their insurer. Greater consistency, more communication with clients, and greater involvement ultimately ensures that the client will be able to take the right action at the right time when they are at their most vulnerable.

Paul Cole is President, inQuba North America, a customer experience management and customer engagement SaaS provider. Based in Los Angeles, Paul has led customer management strategy, technology and operations practices at Ernst & Young, Mercer and CapGemini. Contact Paul at paul.cole@inquba.com. Dr. Warren Moollan is a highly experienced insurance specialist and business strategist at inQuba. He has led and managed insurance operations of several organizations, and has served on several executive management teams responsible for the strategy and planning to enhance the customer experience, including global businesses. Contact Warren at Warren.Moollan@inquba.com.

Robin L. Spaulding, CPCU, AIC, is a Principal within Capgemini’s Global Insurance Practice. Robin is a 25 year insurance industry veteran and an experienced system delivery and strategy consultant. She provides Capgemini’s clients with industry in-sights and best practices. Contact Robin at robin.spaulding@capgemini.com.