Could Net Promoter Score be disadvantaging your business?

Businesses have implemented NPS (Net Promoter Score), and other measurement systems, to achieve CX success and superior customer experiences. Consumers have benefitted overall, and the growth in adoption of NPS has resulted in the C Suite’s interest in the customers’ experience. Ten years ago, good customer service was appreciated, and today it’s expected, to quote Shep Hyken*. Forbes quotes a Wall Street Journal analysis, saying NPS was cited more than 150 times in earnings conference calls by 50 S&P 500 companies in a year, and no company ever said it’s NPS declined!* Management snake oil, anyone?

You’ll know that NPS is a method used to measure customers’ loyalty using a single survey question. It’s an 11-point recommendation question and the scores are frequently used to indicate satisfaction or relationship health. There’s appeal in its simplicity and industry benchmarks, and it’s become the darling of traditional CX programs and professionals alike. Now we need to ask whether the metric is moving the right needles!

The trouble with NPS

1. Limited scope

Blinkers are for racehorses. Focusing the business on a single metric such as NPS usually happens to the exclusion of other important things. For instance, satisfaction throughout the end-to-end customer journey has a measurable impact on business revenue, but NPS won’t measure this. NPS also provides no insight on product quality, customer service or pricing. Customers can have poor experiences and still being willing to recommend the brand for various reasons.

2. Limited context

There’s no why behind the ratings. Imagine you’ve discovered that some branches have a lower NPS than other branches. What have you learned? The scores may offer hints on where to focus, but it’s a trailing indicator – a rear-view mirror measurement – confirming things that are probably known anyway. Without reasons for ratings there’s no path to root causes.

3. Bias

How are you feeling today? Ratings can be biased based upon various factors such as timing of the survey, the wording of the questions, or the customers’ most recent interaction with you. For instance, NPS best practice suggests that it should be measured as it relates to the overall relationship with the brand. However, many businesses lump the question into an experience survey where the result will be infected by the actual experience, good or bad.

4. It’s an incomplete picture

Markets are made up of individuals. NPS is a snapshot at a point in time and doesn’t consider broader variables like demographics, changes in customer behaviour and shifting market trends. Younger consumers rate differently to older consumers, for instance. If you noticed a change in the NPS trend over time, was is due to an improvement in your products, services and experiences, or was there a fundamental change in the market?

5. Gamification

NPS is easily gamed, especially when it’s made the most important thing and linked to KPIs. Businesses can fall into the trap of only surveying their most satisfied customers (or friends and relatives!), thereby covering up average-to-poor experiences. Sometimes customers are even (quietly) asked for what their rating will be prior to being officially surveyed, so that they can be triaged and presumably excluded.

6. Bonus Point: Intention vs. reality

There’s what you say, and then there’s what you do. There’s a disconnect between what people say and how they behave. New Year’s resolutions come to mind. Mentioned in our previous article on the topic: a study published by HBR revealed that consumers’ intention to recommend usually stays just that – an intention – without becoming a reality. Consumers can recommend a brand and discourage others, depending upon the context.

The trouble with NPS

- Limited Scope

- Limited Content

- Bias

- Incomplete Picture

- Gamification

- Intention vs Reality

Real impact

Any single measurement system in isolation will result in the challenges mentioned. If needed, NPS should be incorporated into a broader approach to experience management.

In contrast to an isolated measurement framework, Customer Journey Management offers real business benefits that span experience and growth. A study by McKinsey found that companies that actively manage customer journeys increase customer satisfaction by 10-15%, reduce costs by 15-20%, and increase revenue by 10-15%*.

By understanding and managing the customer journey, businesses can identify pain points and opportunities to improve the customer experience at each step. This holistic approach to customer experience management can lead to more seamless and enjoyable experiences for customers, which can ultimately result in increased loyalty, higher customer satisfaction scores, and increased revenue.

Here’s how it works:

5 steps to great experiences & boosted revenue

1. Discover real customer journeys

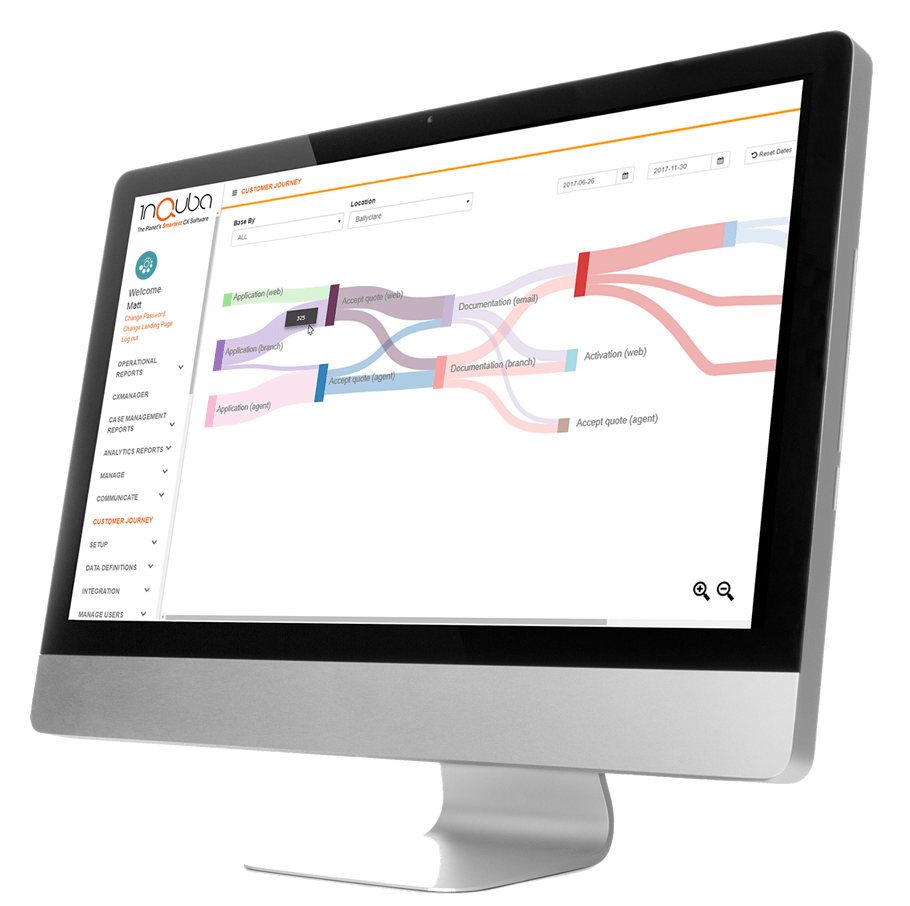

What’s stopping your customers from reaching their goals? Real customer journeys aren’t the conceptual journeys that we map out in boardrooms, but rather what’s happening in reality. Businesses need the ability to unify their customer data and visually discover how journeys are playing out, and where customers are leaving. Which customers are reaching their goals, and which ones are dropping off? Are certain channels resulting in successful or unsuccessful journeys? What obstacles and channel sequences result in drop offs? Without visibility of real journeys these questions cannot be answered.

2. Measure actual value delivery

Are you delivering value? It shouldn’t be a mystery. Does your business understand the extent to which your customers perceive value as having been delivered? Today’s customers are mobile and omni-channel. Dynamic mechanisms should be used to measure sentiment and collect feedback at every step of their journeys, in real time. Unstructured feedback from social channels? Analyse it algorithmically to extract sentiment and themes, and build an emotional curve. You’ll now have layered insight – real journeys and actual emotion – which will help you with the next step.

3. Understand goal success, and failure

The two previous steps have provided the what and the why. Having discovered actual journeys (step 1) and overlaid the perception of value delivery (step 2), you can now determine whether goals are being achieved or not, and why.

- Are bank card applicants dropping off due to poor functional value delivery, or merely effort?

- Are insurance clients terminating due to poor brand factors, or is it a channel failure?

- Are mobile network customers upgrading due to positive brand experiences at a particular touchpoint?

Different segments will react differently at different points of their journeys. This deep insight is invaluable when designing corrective measures.

4. Design intervention strategies

Customers demand personalisation more than ever. Empowered with deep, layered insight on goal achievement, organizations need a tool-box of approaches that will move customers forward when they get stuck. These may be in the form of digital nudges (such as a personalised prompt to an applicant to provide outstanding information), a value communication (such as a reminder of a particular benefit), or even contact by a consultant. Interventions need to be contextual, personalised and relevant, driven by a single view of every unique customer.

5. Review and optimise further

Finally, review the effectiveness of your interventions. Did the interventions boost customer conversion? Did the nudges reduce customer drop off? Which nudge was most effective? How have these decisions translated in terms of customer experience and value delivery? Analytics will provide a view of outcomes against control groups, and across segments. Effectiveness insight will then inform the fine-tuning of digital nudges and other interventions, further optimizing for ROI.

References:

- https://hyken.com/customer-service-3/10-years-ago-customer-service-appreciated-today-expected/

- https://www.forbes.com/sites/ronshevlin/2019/05/21/its-time-to-retire-the-net-promoter-score/?sh=c1602196bbb9

- https://www.mckinsey.com/capabilities/operations/our-insights/the-ceo-guide-to-customer-experience